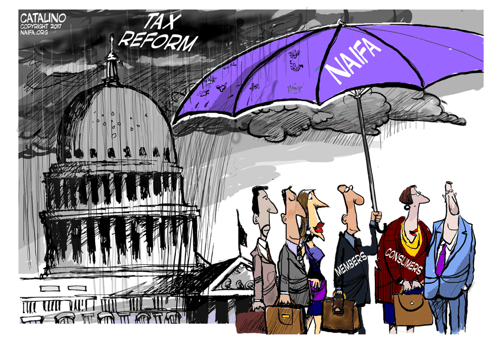

We know what’s in the tax bill, now it's time to figure out how it will impact your business and clients.

Normally these sessions are for members only, but people that saw the live broadcast called it a "must see" webinar for financial advisors, so we are making it available to non-members as well.

This exclusive webinar is focused on the critical aspects of the Tax Cuts and Jobs Act that will impact your practice and change the way you plan for your clients financial success. Just some of the covered topics include:

Presented by: Robert S. Keebler, of Keebler & Associates, LLP, one of the most respected authorities on Tax Law.

Sign up to view the recording of this free "members only" webinar below.

WHAT'S IN IT FOR YOU?

National Association of Insurance and Financial Advisors

2901 Telestar Court | Falls Church, VA 22042-1205

Phone: 877-866-2432

Privacy Policy, Use of Data & Legal Notices | NAIFA Code of Ethics

© 2018 NAIFA All Rights Reserved.

|

NEW! Sign up for NAIFA Solution Center |